Exploring the realm of Small Business Health Insurance Plans That Save You Thousands, this introduction invites readers into a world where financial savings and employee well-being converge.

As we delve deeper, we will uncover the intricacies of cost-effective health insurance solutions tailored for small businesses, offering a glimpse into a realm of benefits and strategies.

Overview of Small Business Health Insurance Plans

Small business health insurance plans play a crucial role in ensuring the well-being of employees while also benefiting the business itself. These plans offer a range of advantages that can save small businesses thousands of dollars in the long run.

Key Features of Small Business Health Insurance Plans

- Cost-Effective Coverage: Small business health insurance plans often provide affordable options for employers, allowing them to offer comprehensive coverage to their employees without breaking the bank.

- Attracting and Retaining Talent: By providing health insurance benefits, small businesses can attract top talent and retain valuable employees, leading to increased productivity and loyalty.

- Tax Benefits: Small businesses may be eligible for tax deductions when offering health insurance plans to their employees, providing additional financial incentives.

- Employee Wellness Programs: Many small business health insurance plans include wellness programs that can help improve the overall health and well-being of employees, reducing absenteeism and healthcare costs.

Benefits for Small Businesses

- Reduced Turnover: Offering health insurance can help small businesses reduce employee turnover rates, as employees are more likely to stay with a company that provides valuable benefits.

- Improved Morale: Health insurance coverage can boost employee morale and satisfaction, leading to a more positive work environment and increased engagement.

- Cost Savings: By investing in employee health and well-being, small businesses can potentially save money on healthcare costs in the long term, as preventive care can help avoid expensive medical treatments.

Types of Small Business Health Insurance Plans

When it comes to choosing health insurance plans for your small business, there are several options available. Each type of plan offers different coverage options tailored to meet the needs of small businesses.

Health Maintenance Organization (HMO) Plans

- HMO plans require employees to choose a primary care physician (PCP) who coordinates all their healthcare needs.

- Employees must get referrals from their PCP to see specialists.

- These plans typically have lower premiums and out-of-pocket costs, but limited provider networks.

Preferred Provider Organization (PPO) Plans

- PPO plans offer more flexibility in choosing healthcare providers without needing referrals.

- Employees can see specialists without a referral, but costs may be higher when going out-of-network.

- These plans usually have higher premiums and out-of-pocket costs compared to HMO plans.

Exclusive Provider Organization (EPO) Plans

- EPO plans combine aspects of HMO and PPO plans by offering a network of preferred providers.

- Employees are required to use providers within the network for coverage, except in emergencies.

- These plans may have lower premiums than PPO plans but offer less flexibility in provider choice.

Point of Service (POS) Plans

- POS plans allow employees to choose between in-network or out-of-network providers.

- Employees can see specialists without referrals, but they may pay more for out-of-network care.

- These plans offer a balance between cost and provider choice compared to HMO or PPO plans.

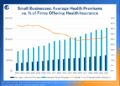

Cost-saving Strategies in Small Business Health Insurance

When it comes to small business health insurance, finding ways to save money is crucial for the financial health of your company. By implementing cost-saving strategies, small businesses can significantly reduce their expenses while still providing quality healthcare coverage for their employees.

Cost-Sharing Benefits for Employers and Employees

Cost-sharing is a strategy where both the employer and employees contribute to the cost of health insurance premiums, deductibles, and other out-of-pocket expenses. This approach can benefit employers by lowering their overall healthcare costs and can also help employees by providing them with more affordable coverage options.

- Employers can negotiate with insurance providers to offer cost-sharing plans that allow employees to pay a portion of their premiums.

- Employees can save money on their healthcare expenses by sharing the cost of premiums, deductibles, and co-pays with their employer.

- Cost-sharing can create a sense of shared responsibility for healthcare costs, leading to more cost-conscious decisions by both employers and employees.

Negotiating with Insurance Providers

When looking for small business health insurance plans, it's essential to negotiate with insurance providers to get the best rates possible

- Research different insurance providers and compare their rates and coverage options.

- Highlight the number of employees you have and the potential for long-term business growth to negotiate better rates.

- Consider bundling health insurance with other types of insurance, such as dental or vision, to get a discount from the provider.

- Be prepared to ask for discounts or additional benefits, such as wellness programs or telemedicine services, as part of your health insurance plan.

Employee Benefits and Wellness Programs

Employee wellness programs are a crucial component of small business health insurance plans as they focus on promoting the overall well-being of employees. By incorporating wellness initiatives, businesses can not only improve the health and productivity of their workforce but also reduce healthcare costs in the long run.

Benefits of Promoting Employee Wellness

- Improved Employee Health: Wellness programs encourage employees to adopt healthier lifestyles, leading to reduced absenteeism and fewer medical claims.

- Enhanced Productivity: Healthy employees are more focused, energized, and motivated, resulting in increased productivity and performance.

- Cost Savings: By preventing chronic diseases and promoting preventive care, businesses can lower healthcare expenses and insurance premiums.

- Boosted Employee Morale: Employees feel valued and supported when their employer invests in their well-being, leading to higher job satisfaction and retention rates.

Successful Wellness Programs Examples

- On-Site Fitness Classes: Offering on-site yoga, Zumba, or fitness classes can encourage employees to stay active and relieve stress.

- Healthy Eating Initiatives: Providing healthy snacks, organizing nutrition workshops, or implementing a subsidized healthy meal program can promote better eating habits among employees.

- Mental Health Support: Offering counseling services, stress management workshops, or mindfulness sessions can help employees manage their mental well-being effectively.

- Financial Wellness Workshops: Educating employees on financial planning, budgeting, and saving strategies can alleviate financial stress and improve overall wellness.

Legal Considerations and Compliance

When it comes to offering health insurance plans as a small business, there are important legal considerations and compliance standards that need to be taken into account. Ensuring compliance with regulations is crucial to avoid penalties and ensure the well-being of employees.

Affordable Care Act (ACA)

The Affordable Care Act (ACA) is a key piece of legislation that impacts how small businesses provide health insurance to their employees. Under the ACA, businesses with 50 or more full-time equivalent employees are required to offer affordable health insurance that meets certain minimum standards.

- Small businesses with fewer than 50 employees are not required to provide health insurance, but they may be eligible for tax credits if they choose to do so.

- Employers must also report information about the health coverage they offer to employees to ensure compliance with the ACA.

- Non-compliance with the ACA can result in penalties for small businesses, so it is important to understand and adhere to the regulations.

Compliance Tips for Small Businesses

Staying compliant with health insurance regulations while also offering cost-effective plans can be a challenging task for small businesses. Here are some tips to help navigate the legal landscape:

- Work with a knowledgeable insurance broker or consultant who can guide you through the regulations and help you find the best plan options for your business.

- Stay informed about changes to health insurance laws and regulations that may affect your business, and make adjustments as needed to remain compliant.

- Ensure that your health insurance plans meet the minimum requirements set forth by the ACA to avoid penalties and maintain employee satisfaction.

- Provide clear and thorough communication to your employees about their health insurance options, coverage details, and any changes to the plans to promote transparency and compliance.

- Regularly review and update your health insurance policies to ensure they align with current regulations and provide the best possible coverage for your employees.

Final Summary

In conclusion, Small Business Health Insurance Plans That Save You Thousands not only provide financial security but also prioritize the health and wellness of employees, fostering a thriving work environment. Dive into the world of cost-effective insurance plans and witness the transformation they can bring to your small business.

Expert Answers

What are the key features of small business health insurance plans?

Small business health insurance plans typically offer coverage for medical expenses, preventive care, and sometimes dental and vision care. They are designed to provide affordable health benefits for employees.

How can small businesses save thousands on health insurance plans?

Small businesses can save money on health insurance by implementing cost-sharing strategies, negotiating with insurance providers for better rates, and considering high-deductible plans paired with health savings accounts.

What are some examples of successful wellness programs for small businesses?

Successful wellness programs in small businesses may include fitness challenges, healthy eating initiatives, mental health resources, and access to wellness activities like yoga or meditation.

![Trulicity Eye Side Effects Lawsuit [2025 Update] | King Law](https://medic.goodstats.id/wp-content/uploads/2025/12/Trulicity-Side-Effects-Common-Serious-Long-term-1-75x75.png)

![Trulicity Eye Side Effects Lawsuit [2025 Update] | King Law](https://medic.goodstats.id/wp-content/uploads/2025/12/Trulicity-Side-Effects-Common-Serious-Long-term-1-120x86.png)